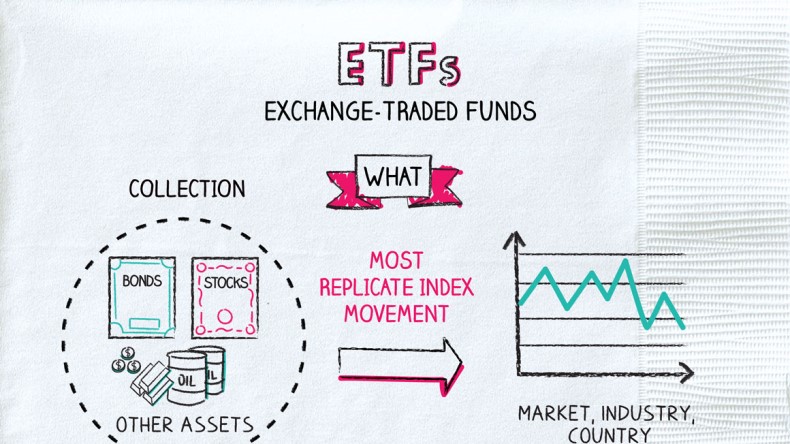

xchange-traded funds are a type of investment fund that offer the best attributes of two popular assets: They have the diversification benefits of mutual funds while mimicking the ease with which stocks are traded.

Exchange-traded fund (ETF) definition

An exchange-traded fund, or ETF, is a fund that can be traded on an exchange like a stock, meaning it can be bought and sold throughout the day. ETFs often have lower fees than other types of funds. Depending on the type, ETFs have varying levels of risk.

But like any financial product, ETFs aren’t a one-size-fits-all solution. Evaluate them on their own merits, including management costs and commission fees (if any), how easily you can buy or sell them, and their investment quality.

How do ETFs work?

An ETF works like this: The fund provider owns the underlying assets, designs a fund to track their performance and then sells shares in that fund to investors. Shareholders own a portion of an

Want the ease of stock trading, but diversification benefits of mutual funds? Take a look at exchange-traded funds (ETFs), which combine the best of both ETF, but they don’t own the underlying assets in the fund.To know more Then exchanger24.org

.png)

Don't be spammer